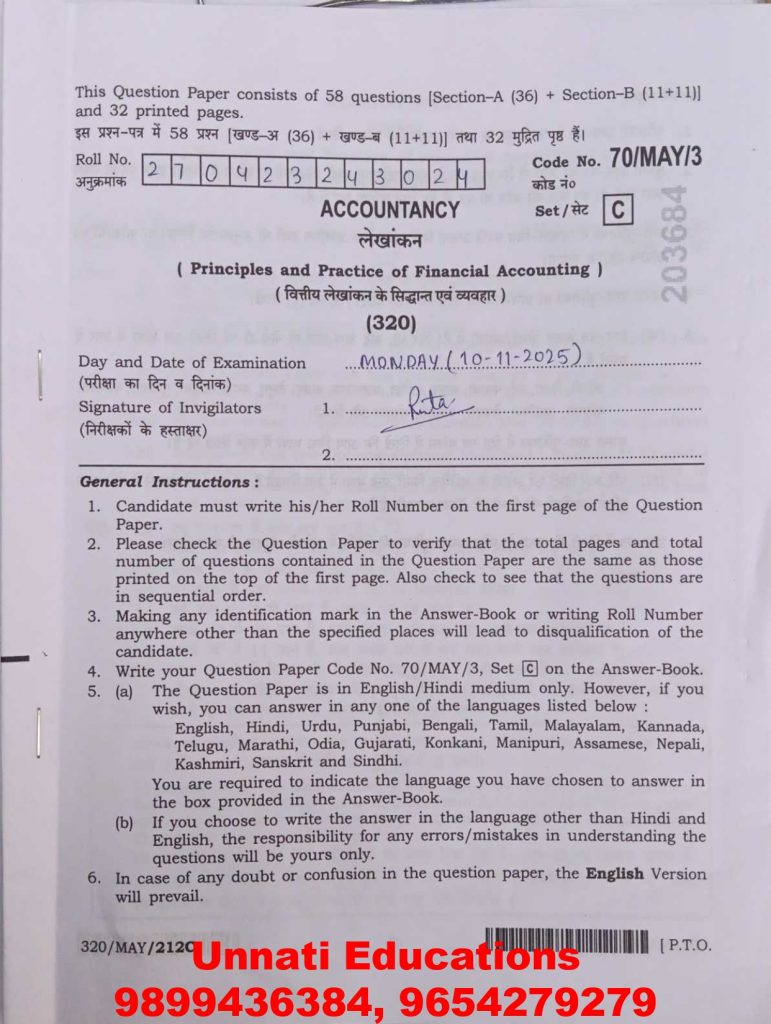

NIOS Class 12 Accountancy 320 Question Paper (Set C) October 2025 – Complete Analysis, Weightage, Trends, and Preparation Guide for 2026

The NIOS Class 12 Accountancy 320 Question Paper (Set C) October 2025 gives a very clear picture of how NIOS evaluates accounting knowledge. This paper focuses more on conceptual clarity, correct treatment of entries, and systematic presentation rather than blind calculations. Students preparing for the 2026 exam can use this analysis as a strong roadmap to score confidently.

This detailed guide is based on a careful review of the complete Set C paper and explains the structure, topic-wise weightage, question patterns, common mistakes, and preparation strategy in simple words so that even average students can understand and apply it effectively.

Download Solved Question Paper PDF

Quick Summary of This Analysis

This comprehensive breakdown of the NIOS Accounts 320 Question Paper explains the full exam structure, section-wise marks distribution, accounting areas tested, and numerical trends. It also highlights expected paper patterns for 2026, scoring topics, and preparation mistakes to avoid. Students looking for clarity and direction in Accountancy will find this analysis extremely practical and exam-oriented.

Overview Table: NIOS Class 12 Accountancy Exam (October 2025 – Set C)

| Particulars | Details |

|---|---|

| Subject | Accountancy (320) |

| Class | 12th |

| Board | National Institute of Open Schooling (NIOS) |

| Question Paper Set | Set C |

| Exam Month | October 2025 |

| Total Marks | 100 |

| Time Duration | 3 Hours |

| Question Types | MCQs, Very Short, Short Answer, Long Answer, Practical Numericals |

| Medium | Hindi / English |

Understanding the NIOS Class 12 Accountancy 320 Question Paper Format

The NIOS Class 12 Accountancy 320 Question Paper is structured to test both theoretical understanding and numerical accuracy. The paper does not reward memorised formats alone. Instead, it checks whether a student understands why an accounting treatment is done and how it affects financial statements.

The paper is divided into clearly defined sections, each testing a different accounting skill such as conceptual knowledge, journal accuracy, problem-solving ability, and presentation discipline.

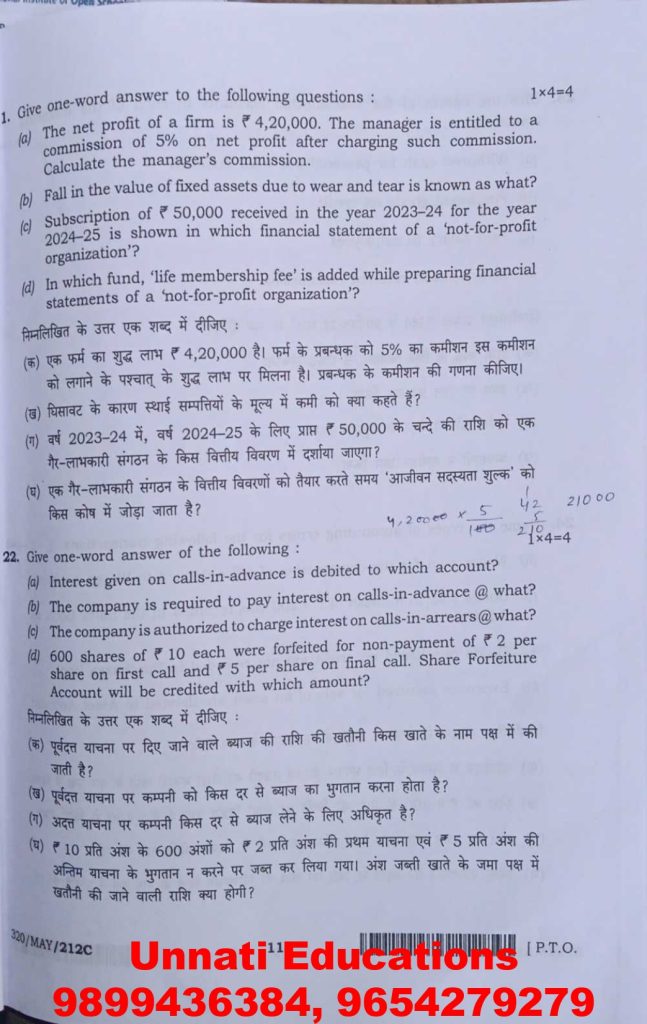

NIOS Class 12 Accountancy 320 Question Paper (Set C) October 2025

Download Solved Question Paper PDF

Structure of the NIOS Class 12 Accountancy Question Paper

Section-Wise Distribution and Purpose

| Section | Nature of Questions | Skills Tested |

|---|---|---|

| Section A | Objective Questions (MCQs) | Concepts, definitions, and accounting principles |

| Section B | Very Short Answer | Terminology, one-line concepts |

| Section C | Short Answer | Treatment-based explanations |

| Section D | Long Answer | Journal entries, theory explanations |

| Section E | Practical Problems | Final accounts, partnership, and company accounts |

Each section is interconnected. Weak basics in Section A usually affect performance in later sections.

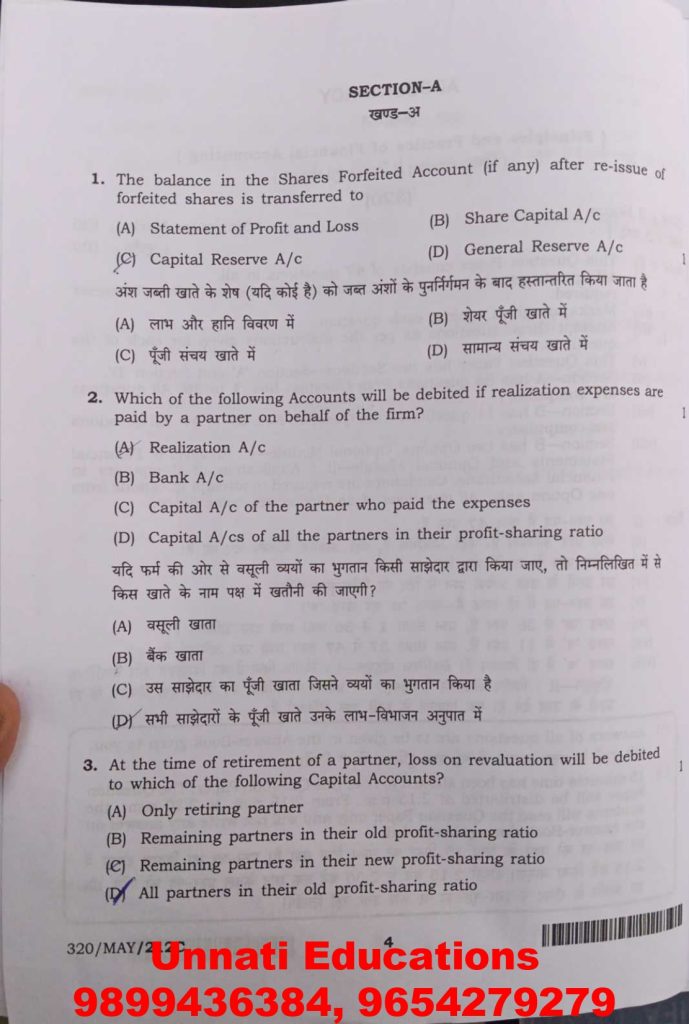

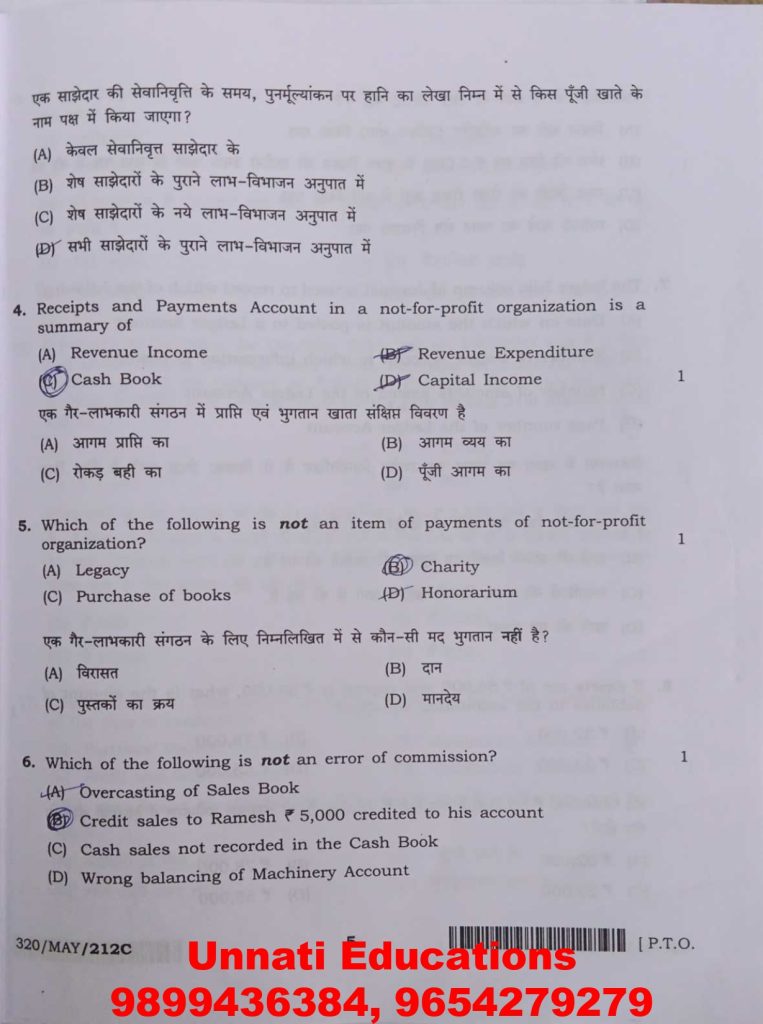

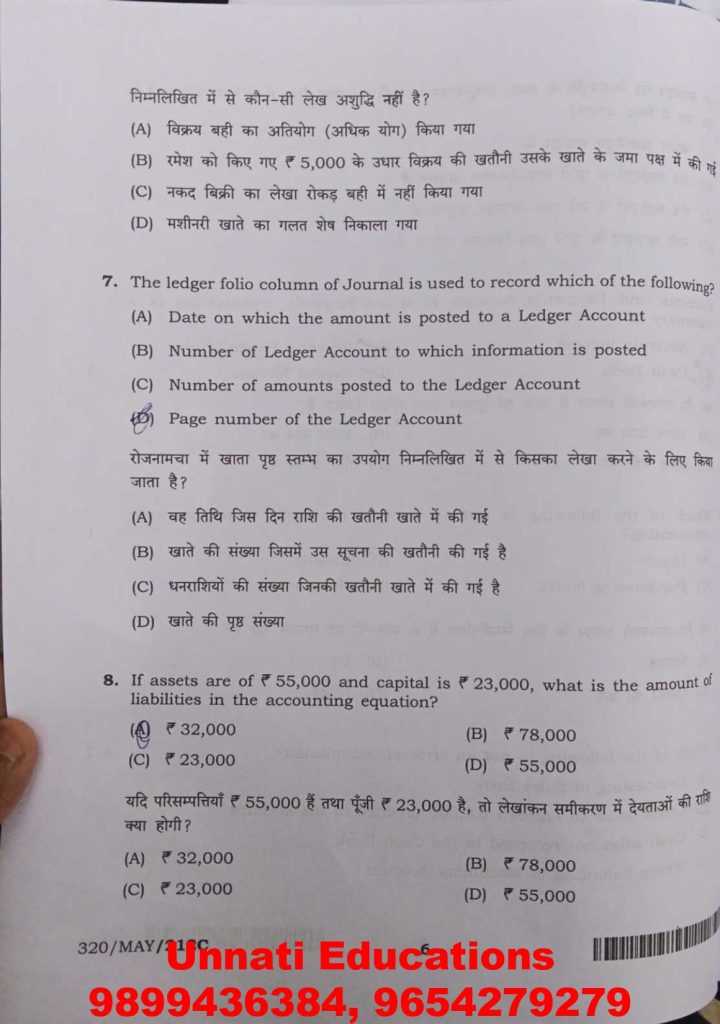

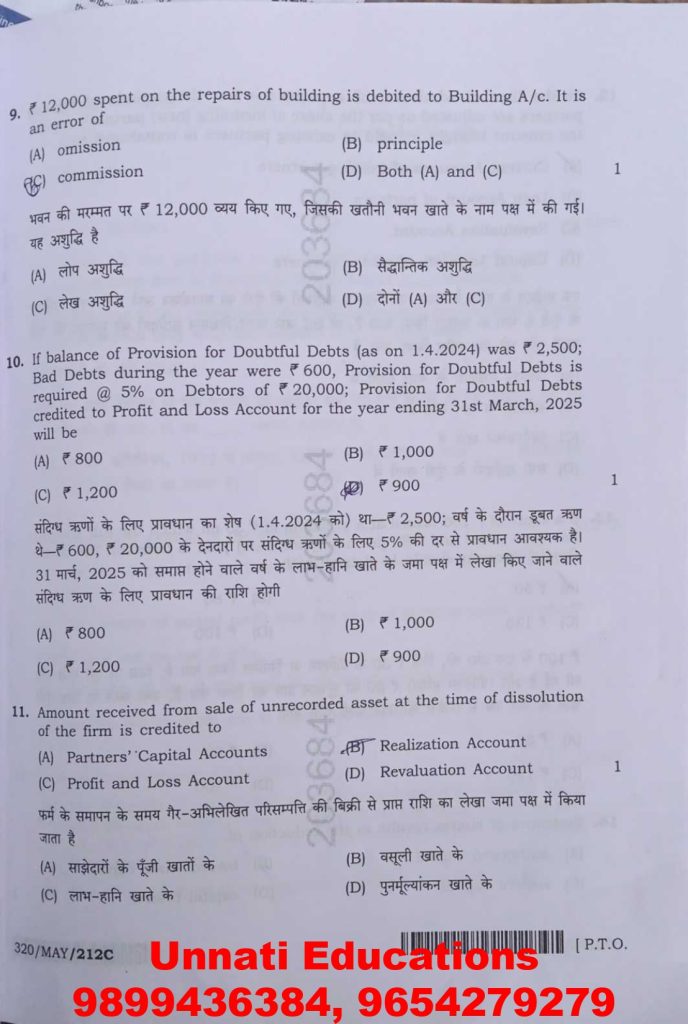

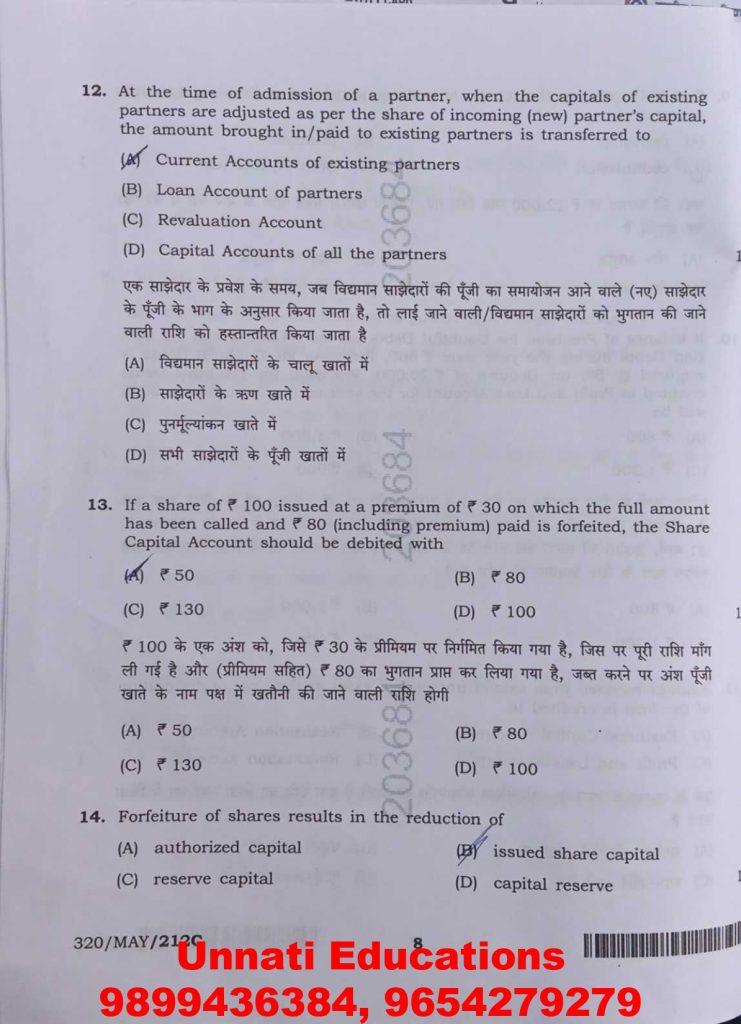

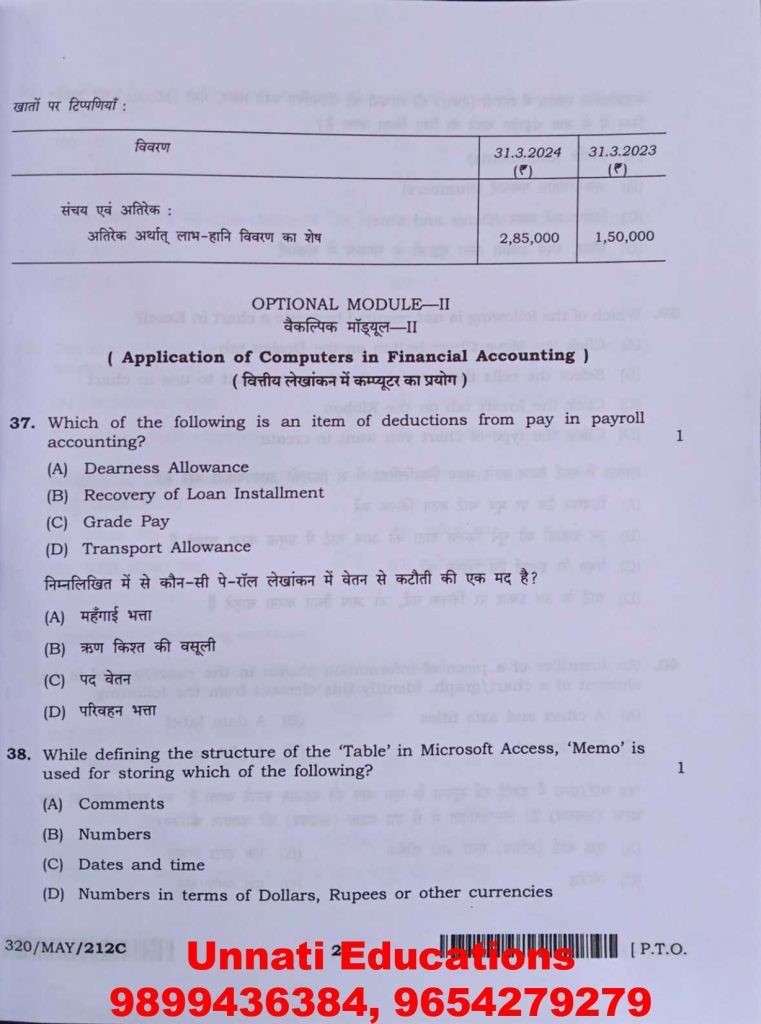

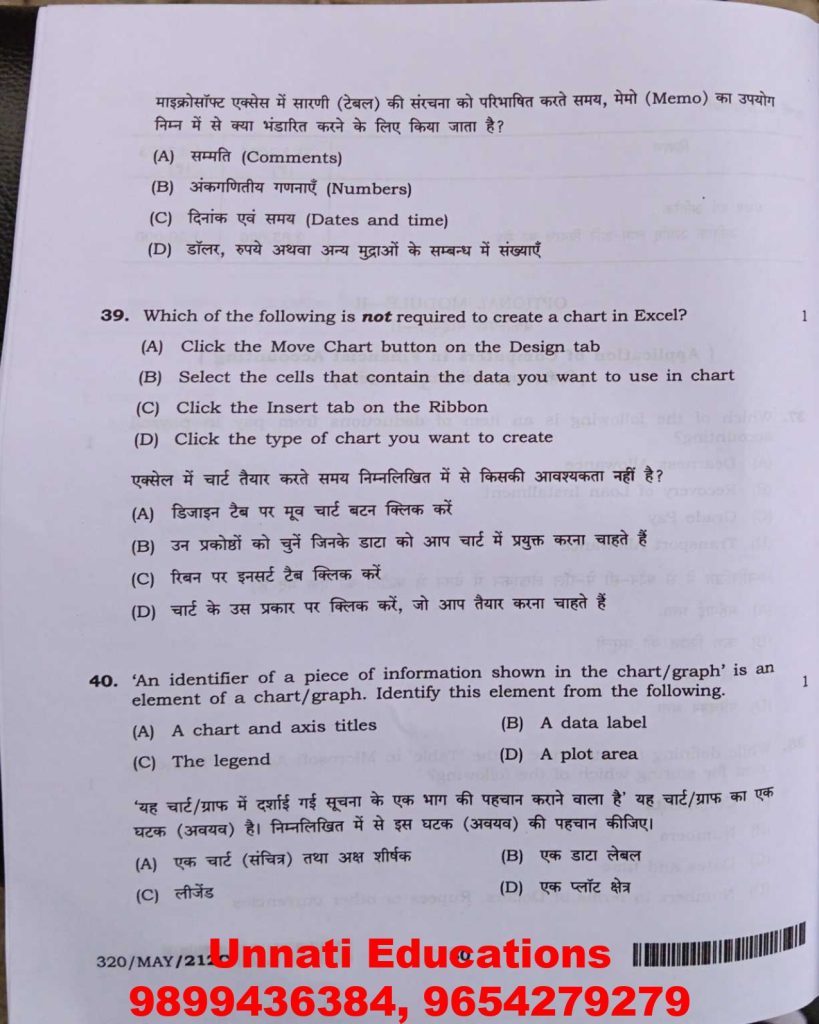

Section A: Objective Type Questions (MCQs)

This section is designed to test whether students understand fundamental accounting logic.

Topics Frequently Asked in Section A

- Accounting principles such as prudence and the matching concept

- Partnership basics like revaluation and capital adjustment

- Errors of accounting and their classification

- Non-profit organisation basics

- Shares and debentures terminology

How to Score High in Section A

- Revise definitions exactly as per the NIOS book language.

- Understand logic behind options, not just answers.

- Avoid guesswork in numerical MCQs

Students who revised the theory chapters carefully found this section easy and scoring.

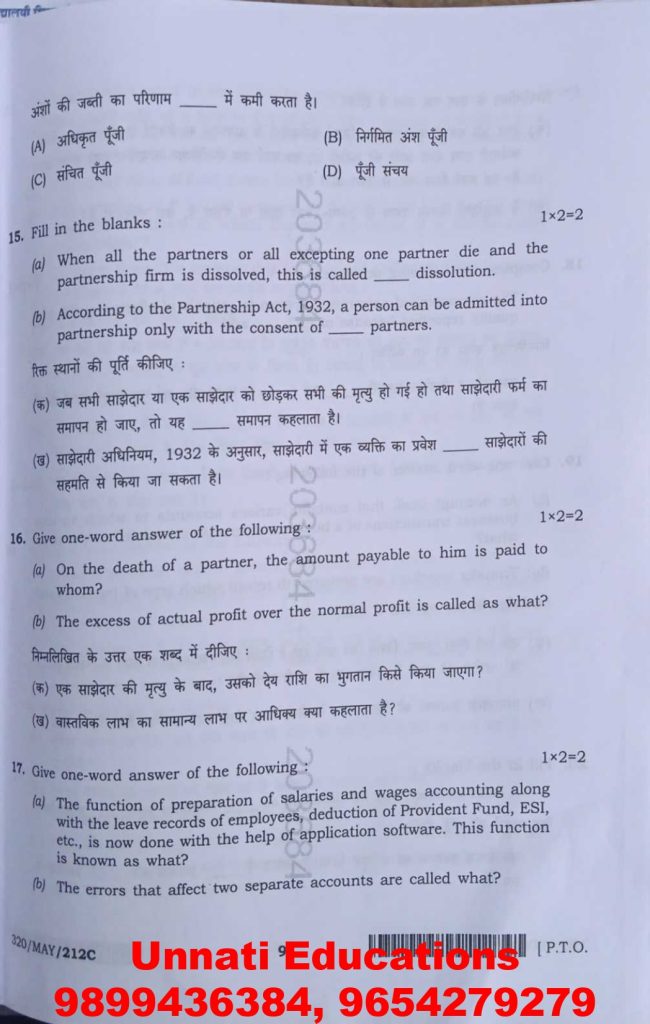

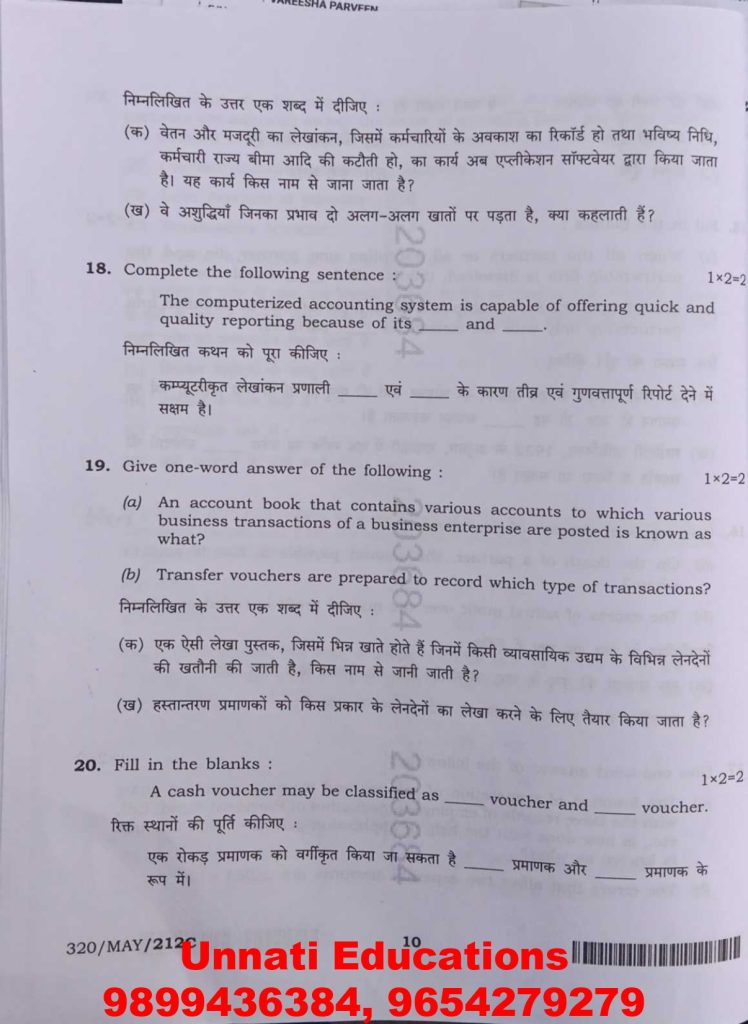

Section B: Very Short Answer Questions

These questions require precise answers without explanation.

Commonly Tested Areas

- Meaning of goodwill

- Definition of capital expenditure

- One-word accounting terms

- Identification of accounts affected

Scoring Strategy

- Answer strictly within one or two lines.

- Use correct accounting terms only.

- Do not write examples unless asked.

Writing extra lines does not increase marks here.

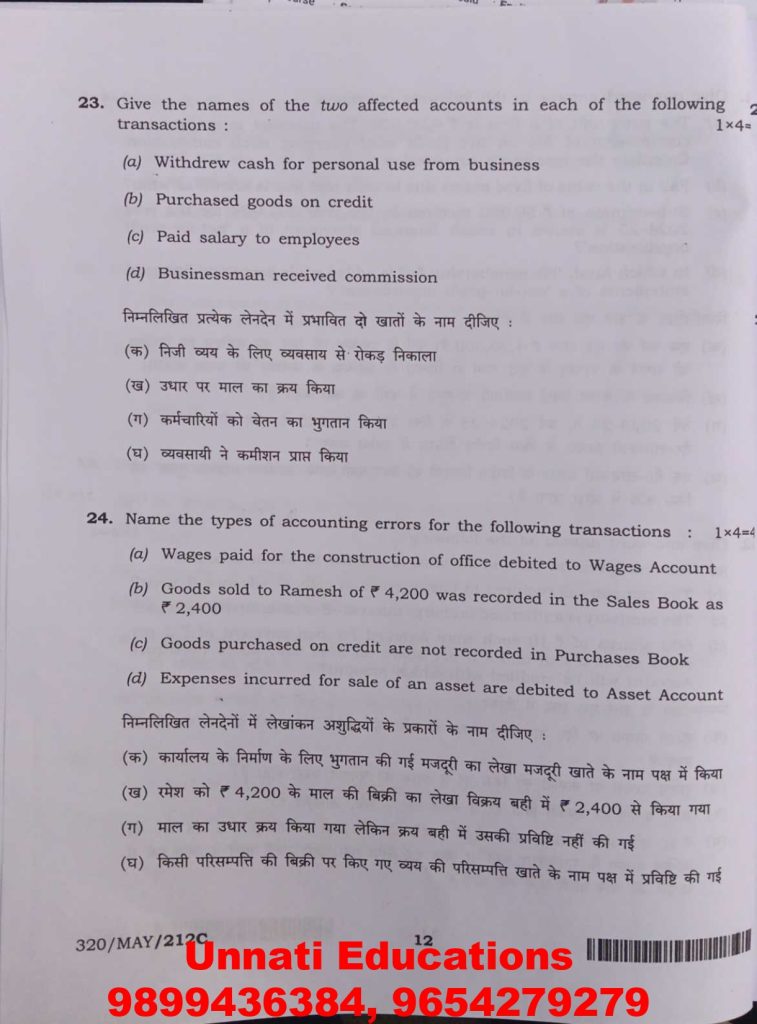

Section C: Short Answer Questions

This section checks conceptual clarity and application.

Topics Seen in Set C

- Types of accounting errors

- Meaning of dissolution of a partnership

- Treatment of outstanding expenses

- Basic partnership concepts

How NIOS Evaluates These Answers

- Clear explanation in points

- Correct accounting logic

- Relevance to the question

Well-structured answers scored higher than lengthy paragraphs.

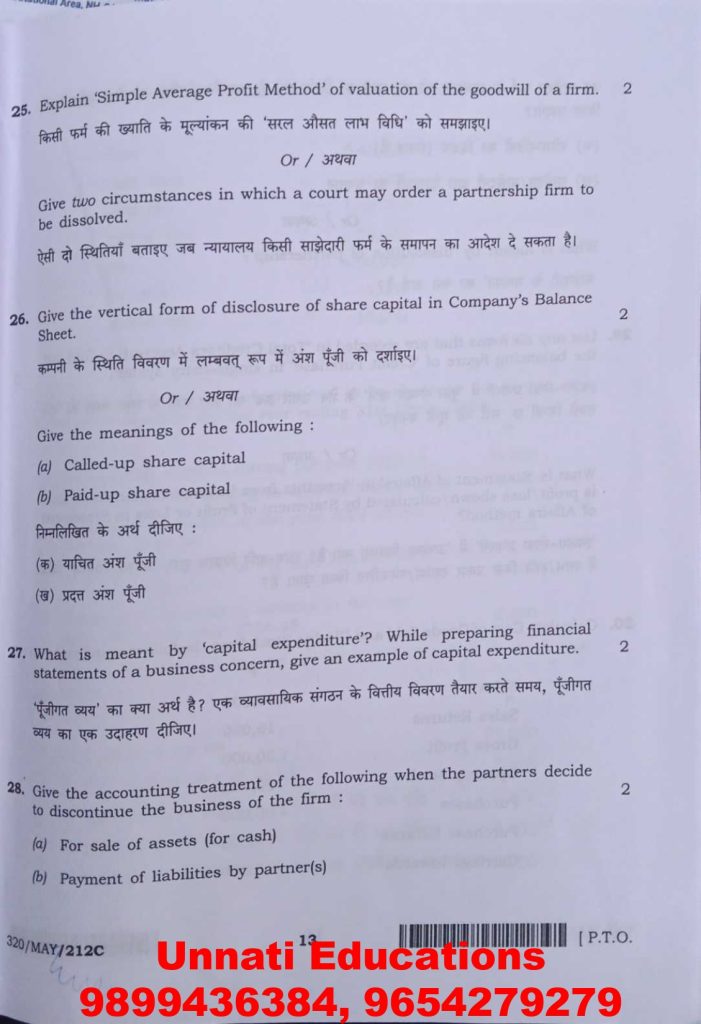

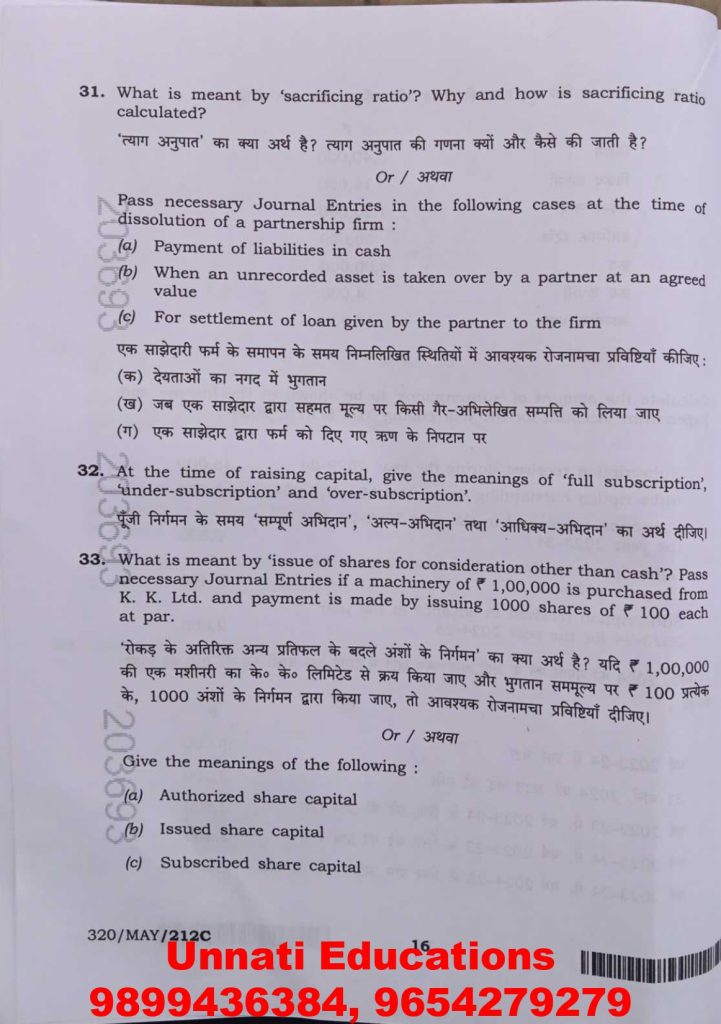

Section D: Long Answer Questions (Theory + Entries)

This section differentiates high scorers from average students.

Theory-Based Long Questions Included

- Simple Average Profit Method of Goodwill Valuation

- Capital vs revenue expenditure

- Meaning of authorised, issued, and subscribed capital.

Entry-Based Long Questions

- Journal entries at the time of dissolution

- Treatment of assets and liabilities

- Accounting for shares issued for consideration other than cash

Marks depend heavily on accuracy and sequence.

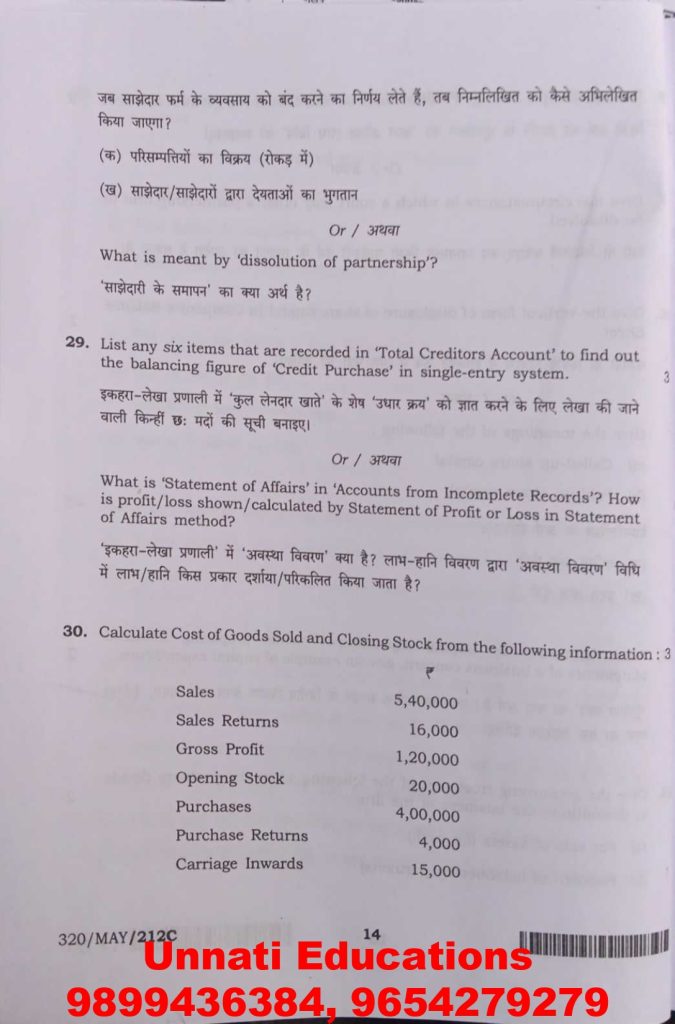

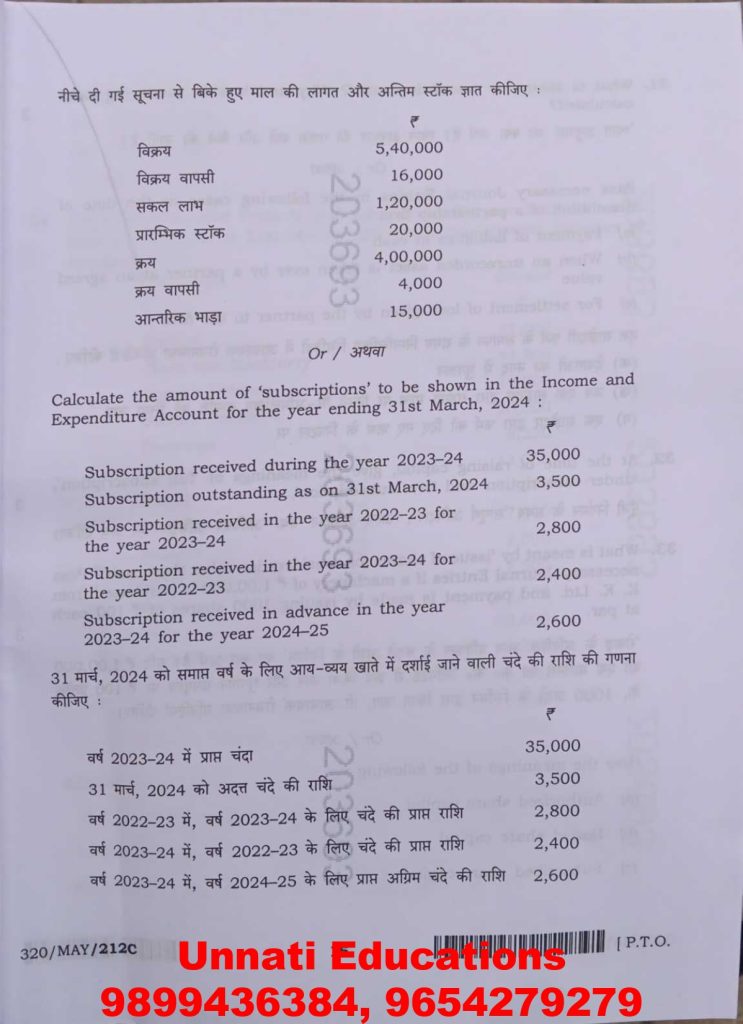

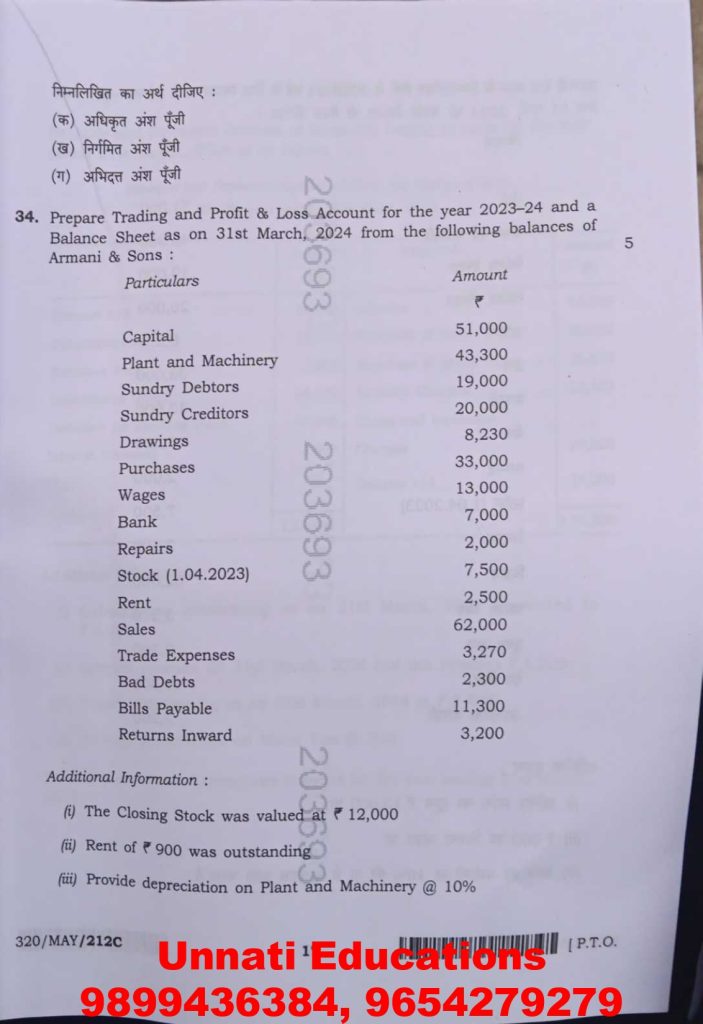

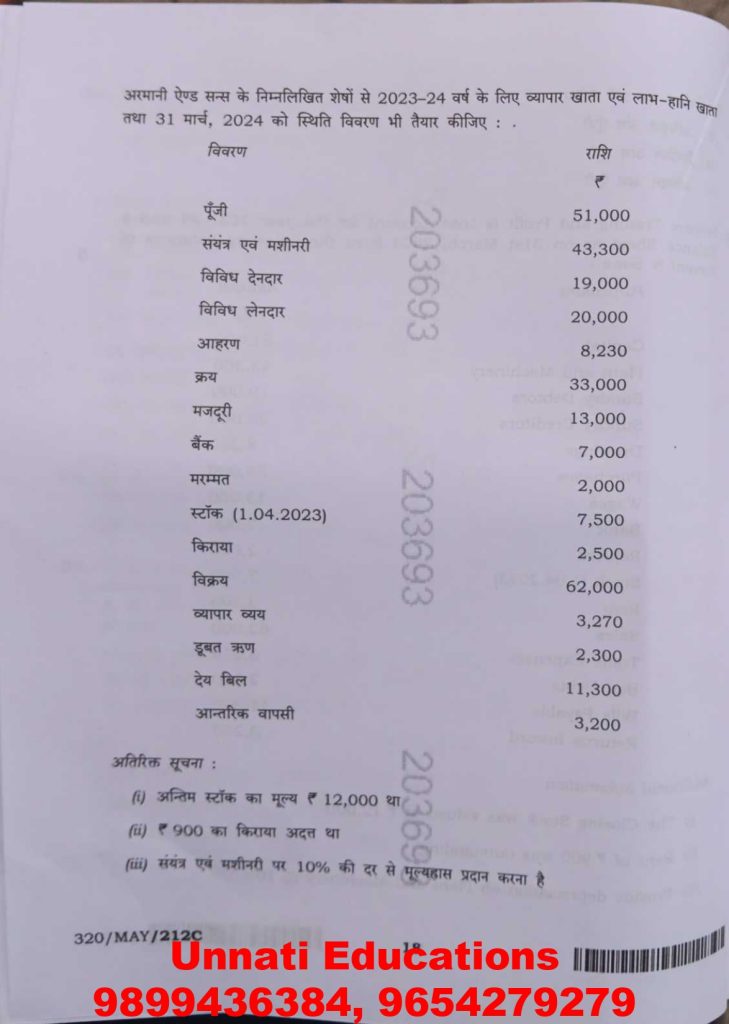

Section E: Practical Numerical Questions (Most Scoring Section)

This section carried the highest weightage and required strong numerical discipline.

Major Practical Areas Covered

- Trading and Profit & Loss Account with Balance Sheet

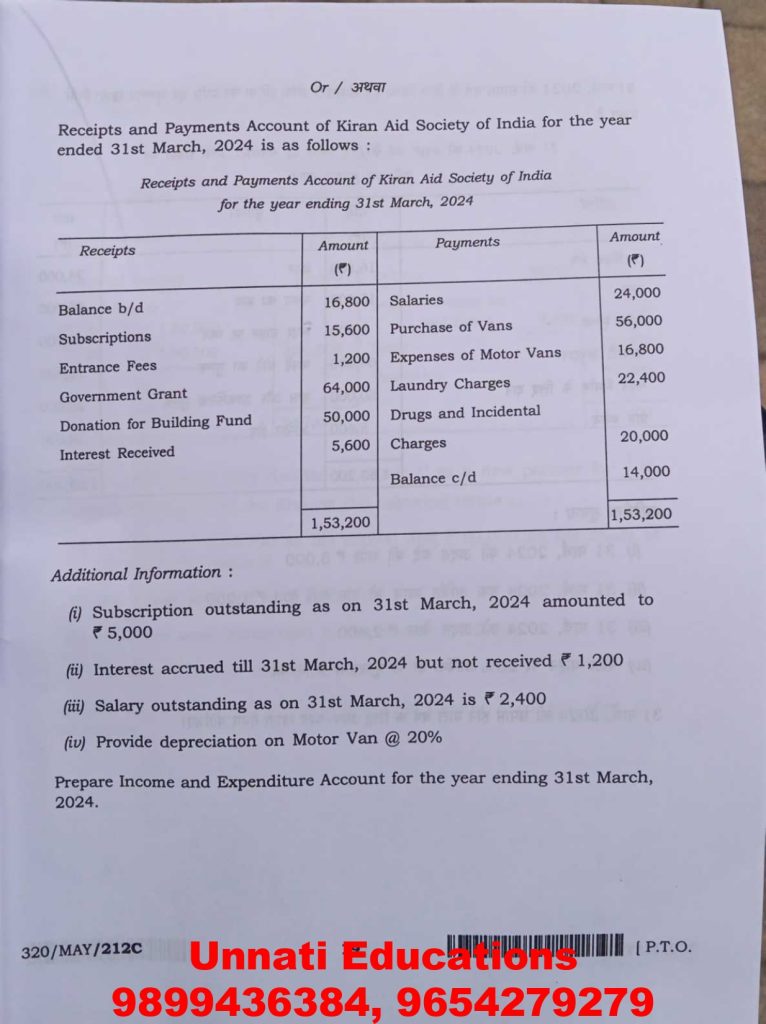

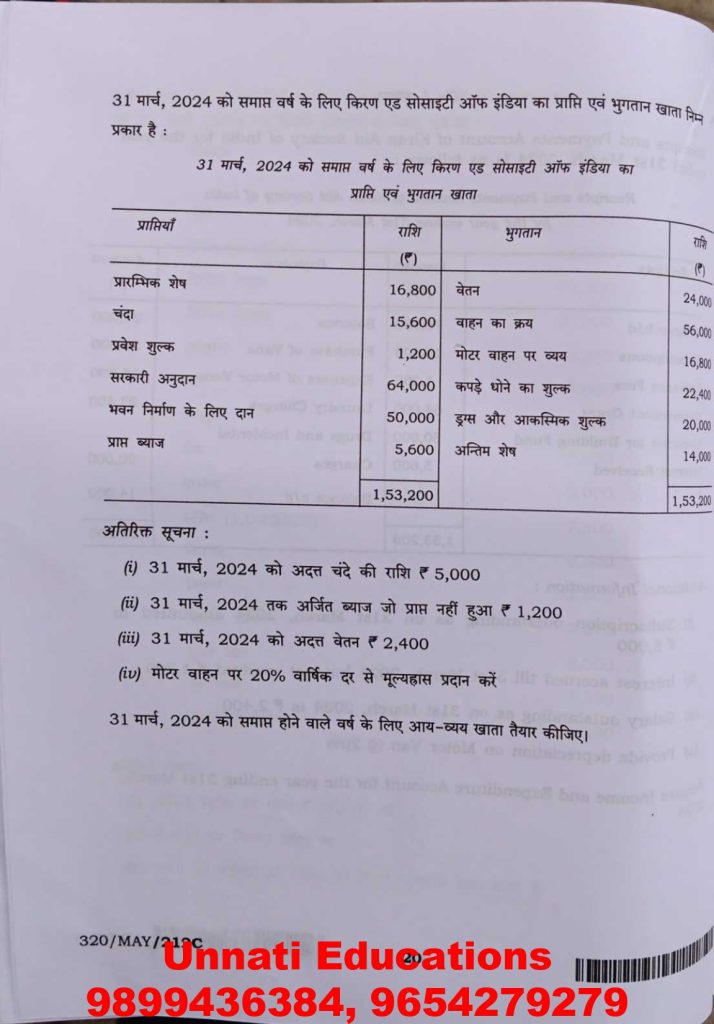

- Receipts and Payments Account of a non-profit organisation

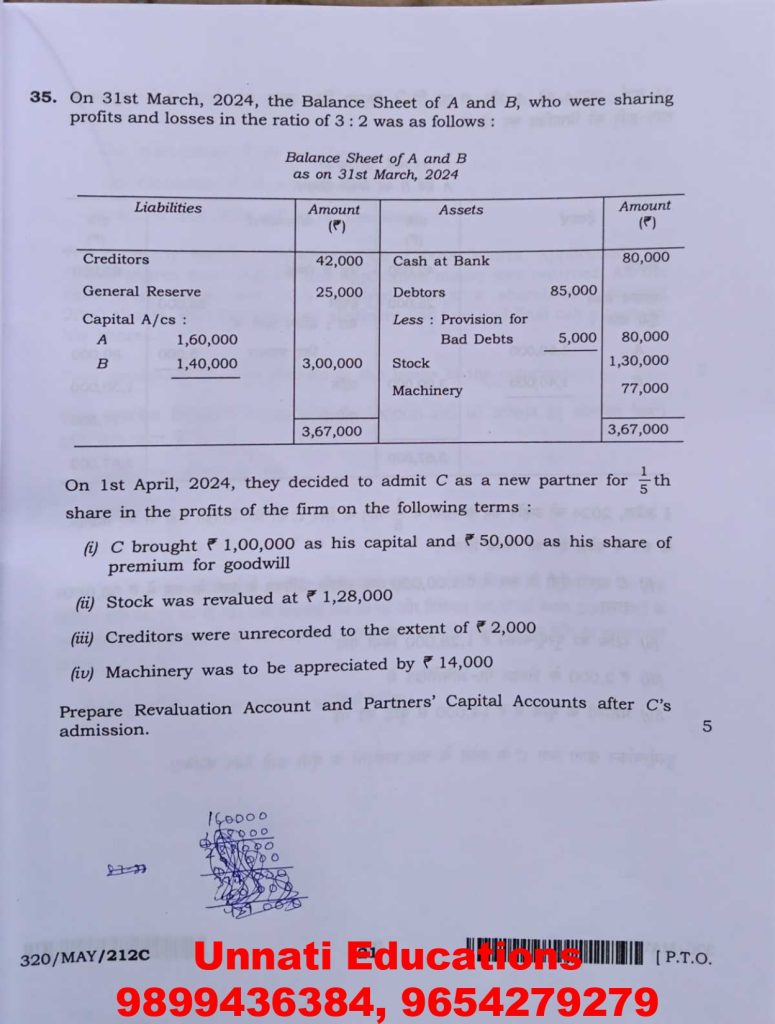

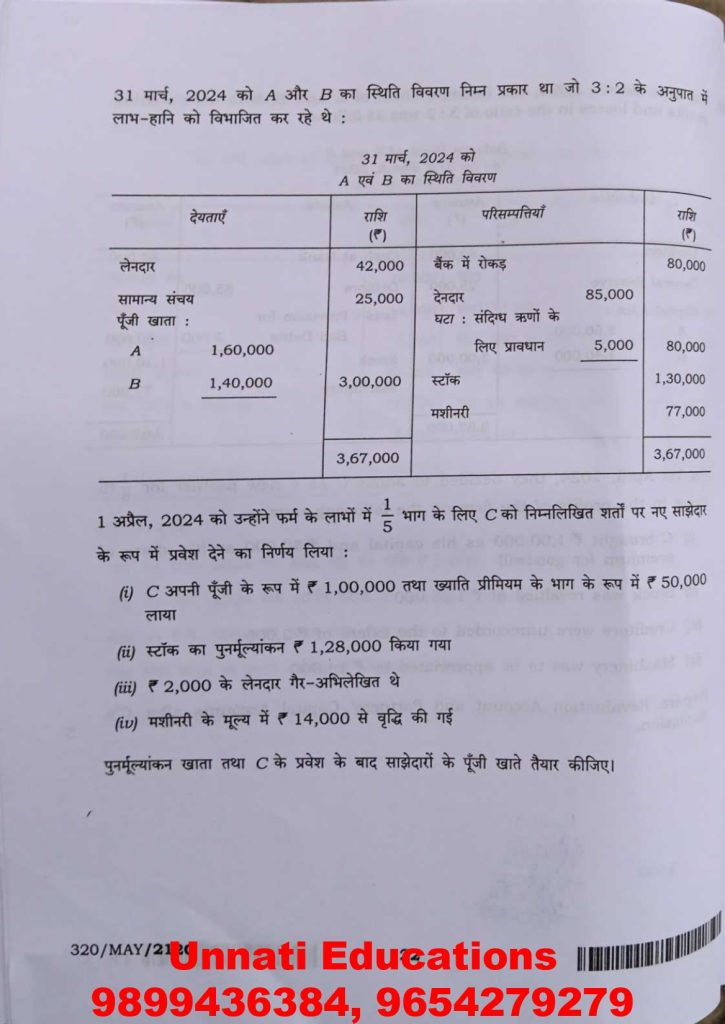

- Partnership admission with revaluation and goodwill

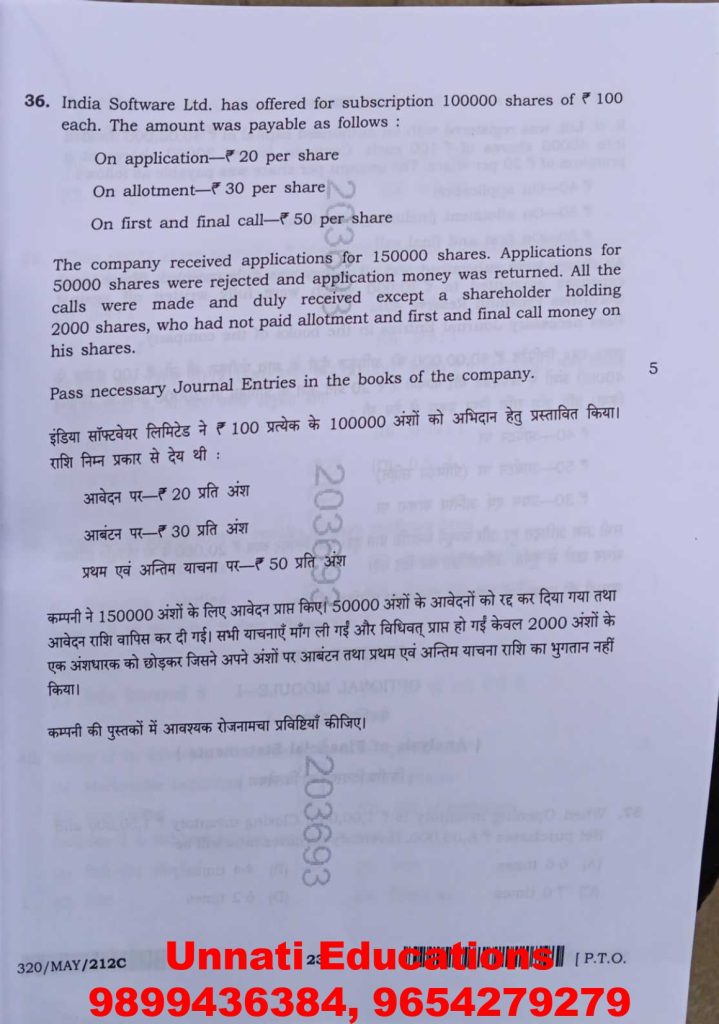

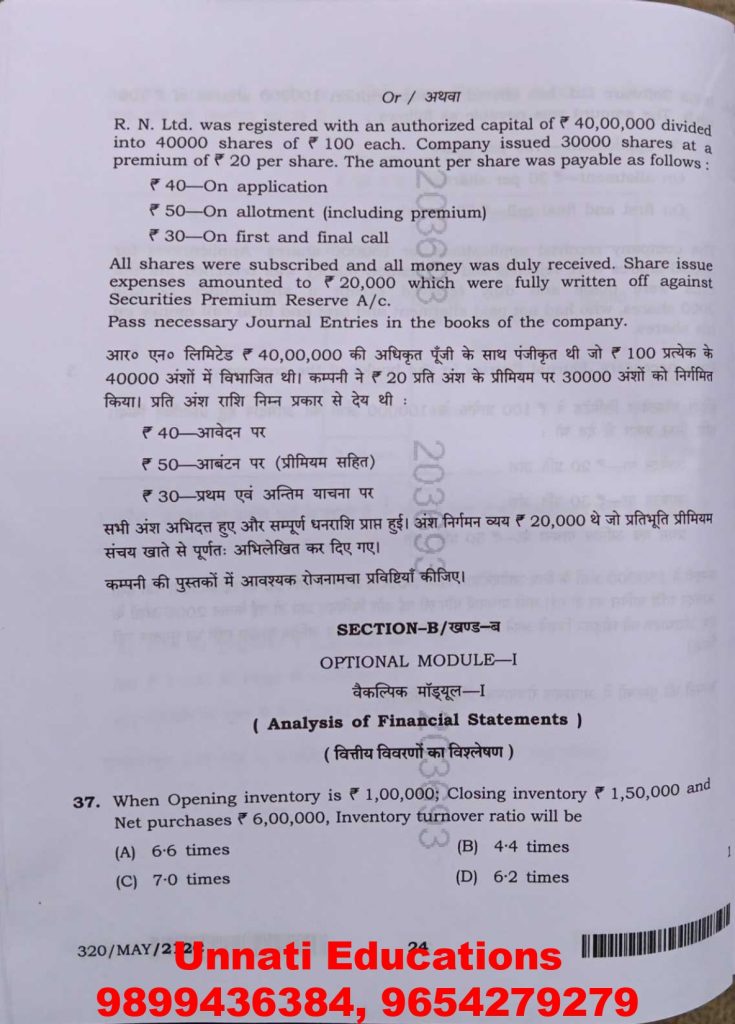

- Issue of shares with application, allotment, and calls

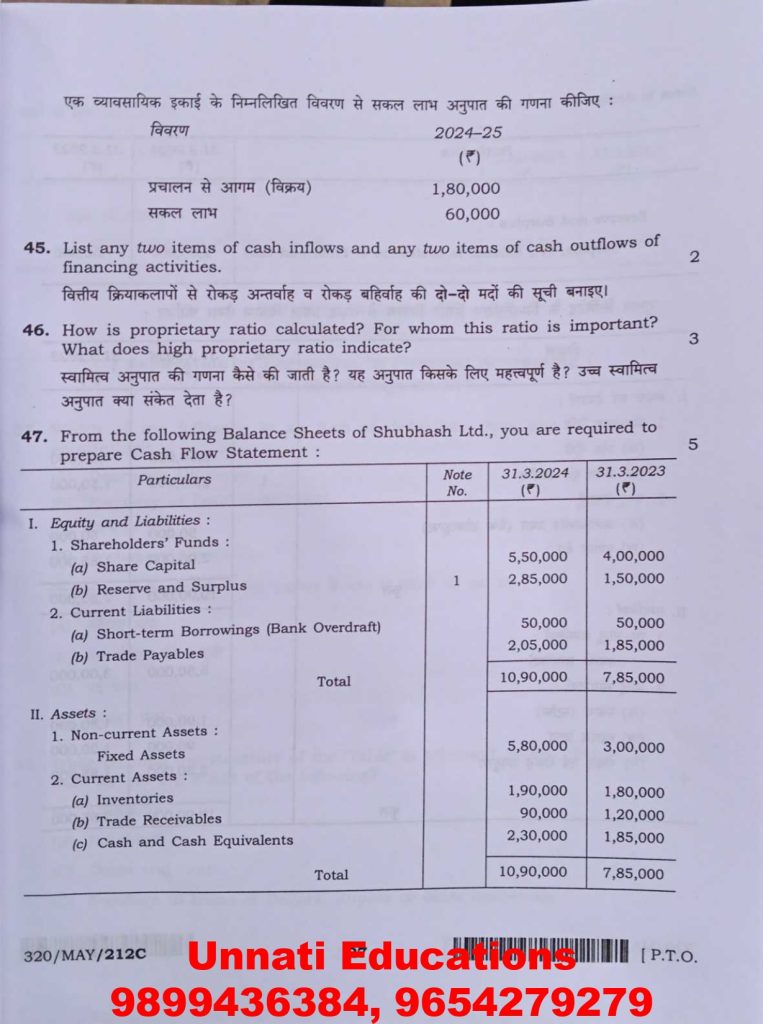

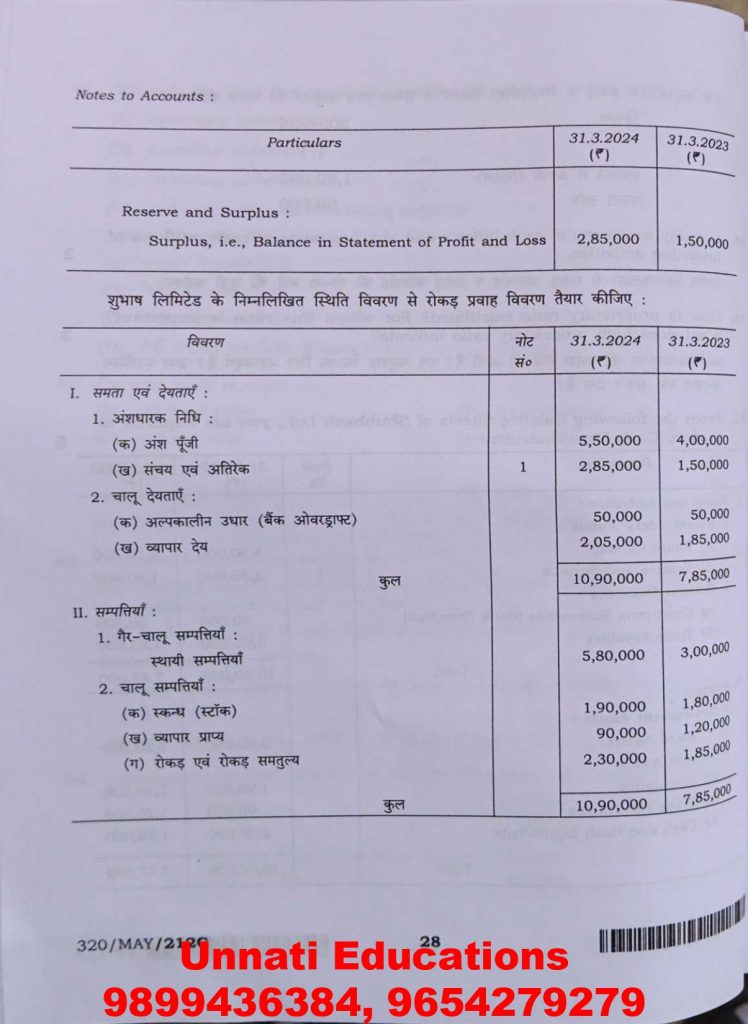

- Cash Flow Statement and Ratio Analysis

Students who practised formats regularly performed significantly better.

Topic-Wise Weightage Analysis (Based on Set C)

| Accounting Area | Approximate Weightage |

|---|---|

| Final Accounts | 25–30 Marks |

| Partnership Accounts | 20–25 Marks |

| Company Accounts | 15–20 Marks |

| Non-Profit Organisation | 10–15 Marks |

| Theory and Concepts | 10–15 Marks |

This distribution is expected to remain similar for 2026.

What This Paper Reveals About NIOS Exam Philosophy

The October 2025 Set C paper clearly shows that NIOS:

- Prefers accuracy over speed

- Rewards correct format and narration

- Penalises careless journal mistakes

- Values conceptual clarity in theory

Students relying only on shortcuts struggled with practical questions.

Common Mistakes Students Made in Set C

Many students lost marks because they:

- Skipped narrations in journal entries

- Made small calculation errors in the final accounts

- Used incorrect formats for statements

- Ignored adjustment details

- Did not revise the basic theory

Avoiding these mistakes alone can raise scores significantly.

Eligibility Criteria for NIOS Class 12 Accountancy (2026)

| Requirement | Details |

|---|---|

| Minimum Age | 16 Years |

| Educational Qualification | Class 10 pass or equivalent |

| Mode of Study | Open Schooling |

| Medium | Hindi or English |

Important NIOS Dates for 2026 (Expected)

| Event | Tentative Timeline |

|---|---|

| Admission Window | January – March 2026 |

| Exam Form Submission | August – September 2026 |

| October Exam | October 2026 |

| Result Declaration | December 2026 |

How Unnati Education Supports Accountancy Students

Unnati Education provides academic support strictly aligned with NIOS exam requirements.

Support includes:

- Solved Accountancy question papers

- Step-by-step numerical solutions

- Structured notes for theory clarity

- Help with NIOS previous year question paper Class 12 practice.

- Dedicated support for NIOS Class 12 TMA preparation

NIOS Class 12 Accountancy 320 Question Paper (Set C) Download PDF – Why Students Search It

Many learners look for NIOS Class 12 Accountancy 320 Question Paper download PDF since working on authentic exams reveals NIOS’s preferred approach to journal entries, ledger posting, trial balance, final accounts, and partnership adjustments. This Set C version serves as an excellent tool for focused 2026 readiness and better scoring.

How to Score High in Final Accounts Questions

Final accounts questions account for a large portion of the total marks.

What NIOS Examiners Look For

- Correct preparation of the Trading Account before the Profit and Loss Account

- Proper adjustment of closing stock, expenses, and incomes

- Logical flow from Profit and Loss Account to Balance Sheet

- Accurate balancing of totals

High-Scoring Preparation Method

- Practice full final accounts problems regularly from start to finish.

- Write headings clearly and underline important figures.

- Show all working notes clearly and separately.

- Double-check totals before moving to the next part.

Students who followed the format strictly scored consistently high.

Partnership Accounts: Concept and Calculation Together

Partnership questions test both understanding and accuracy.

Common Partnership Areas in Set C

- Admission of a partner with goodwill adjustment

- Revaluation of assets and liabilities

- Capital adjustment among partners

- Distribution of profit and loss

Smart Scoring Strategy

- Always prepare the Revaluation Account first.

- Adjust goodwill clearly through partners’ capital accounts.

- Use the correct old and new profit-sharing ratios.

- Maintain neat capital account formats.

Small mistakes in ratios cause large mark loss, so accuracy is critical.

Company Accounts: Easy Marks If Steps Are Followed

Company accounts questions are systematic and predictable.

Topics Repeatedly Tested

- Issue of shares at par and premium.

- Shares issued for consideration other than cash.

- Journal entries for application, allotment, and calls.

- Meaning of authorised, issued, and subscribed capital.

How to Maximise Marks

- Write journal entries in proper sequence.

- Include narration wherever required.

- Maintain clarity between debit and credit sides.

- Avoid overwriting and cutting.

Company accounts reward discipline more than speed.

Non-Profit Organisation Questions: Simple but Careful

Non-profit organisation questions are conceptually easy but require attention.

Areas Asked in Set C

- Receipts and Payments Account

- Income and Expenditure Account

- Capital Fund calculation

Scoring Approach

- Understand the difference between capital and revenue items.

- Adjust subscriptions properly

- Prepare working notes clearly.

- Follow the correct format strictly

Students who revised basic concepts found this section very scoring.

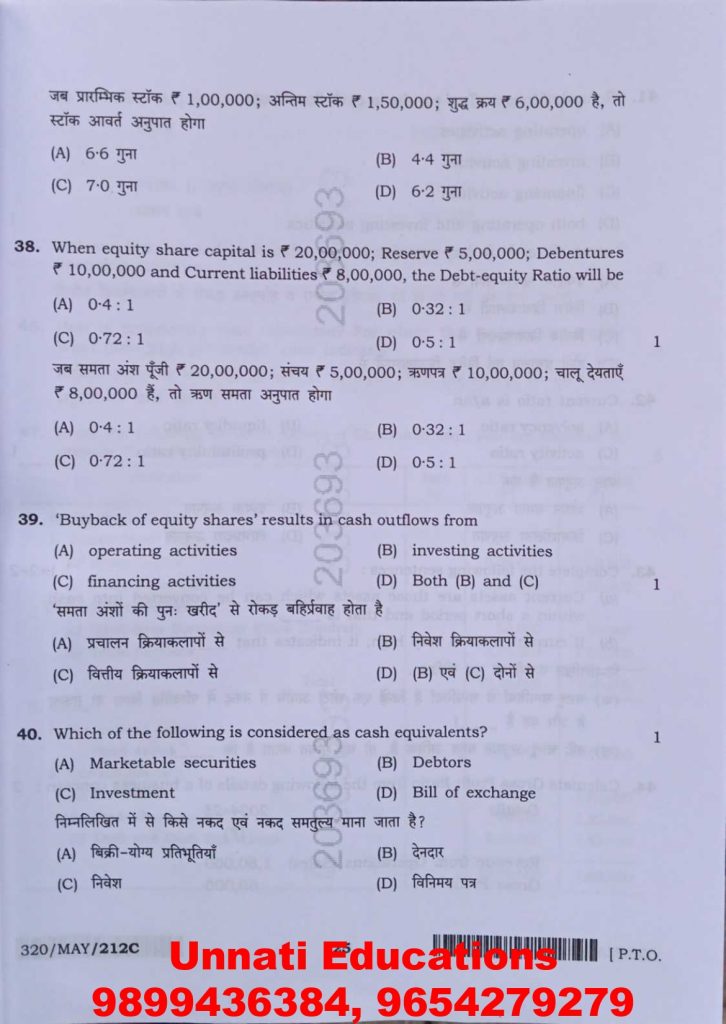

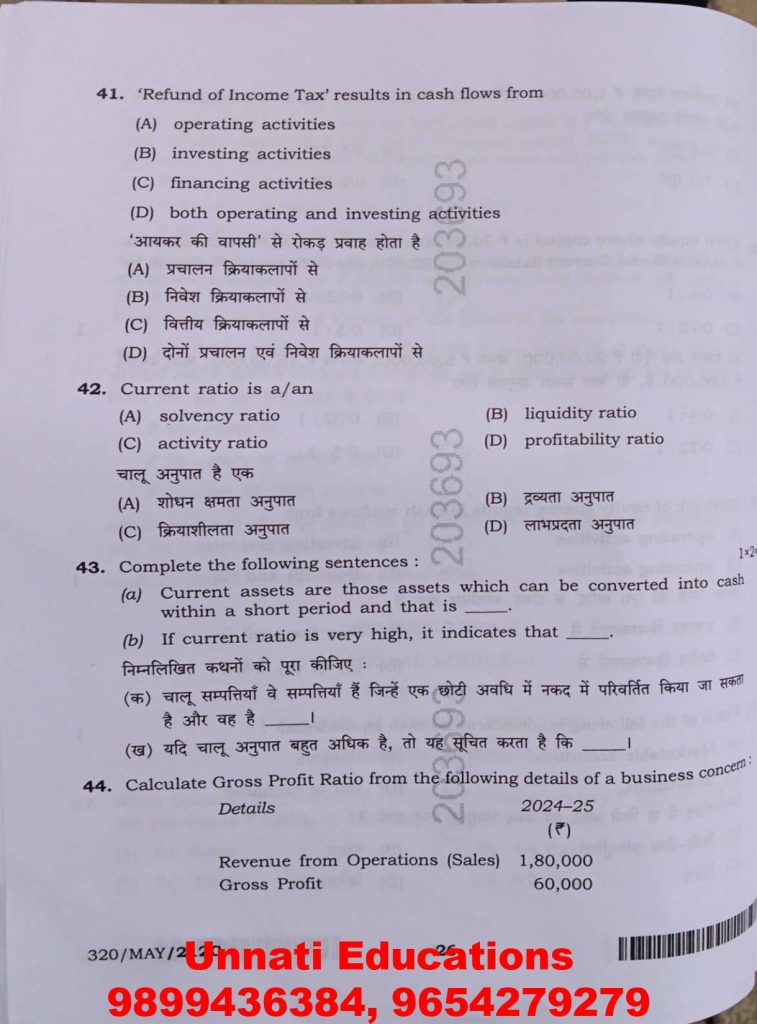

Cash Flow Statement and Ratio Analysis

These questions test interpretation rather than memorisation.

What NIOS Focuses On

- Correct classification of cash inflows and outflows

- Logical calculation of ratios

- Proper formula application

Best Preparation Method

- Memorise formulas with understanding.

- Practice at least one question daily.

- Write calculation steps clearly.

- State the final answer clearly with units

Skipping steps often leads to partial mark loss.

Time Management Strategy for Accountancy Exam

Proper time management improves accuracy.

| Section | Suggested Time |

|---|---|

| Objective and Very Short | 30 minutes |

| Short Answer | 30 minutes |

| Theory Long Answers | 30 minutes |

| Numerical Problems | 80 minutes |

| Revision | 30 minutes |

Do not rush numbers. Accuracy matters more than speed.

Presentation Tips That Improve Accountancy Scores

- Draw proper tables and formats with straight lines.

- Leave space between different accounts.

- Underline headings and totals neatly.

- Write narrations clearly below journal entries.

- Avoid erasing repeatedly, as it reduces clarity.

A good presentation makes checking easier and improves the impression.

Expected Trends for NIOS Accountancy 320 Exam 2026

Based on Set C analysis, students can expect:

- Similar question paper structure

- Continued focus on final accounts and partnership

- Regular inclusion of company accounts

- Balanced theory and numerical questions

NIOS follows a stable pattern and avoids sudden changes.

Smart 2026 Preparation Plan for Accountancy

Daily Plan

- 30 minutes of numerical practice

- 20 minutes of theory revision

- 10 minutes of format memorisation

Weekly Plan

- One full-length practice paper

- One revision of partnership concepts

- One revision of the company accounts

Consistency over months gives better results than a last-minute study.

How Unnati Education Helps Accountancy Students

Unnati Education supports NIOS Accountancy students with exam-focused academic guidance.

Support includes:

- Solved Accountancy question papers with step-wise solutions

- Simplified notes for theory clarity

- Numerical practice support for weak areas

- Help with NIOS Class 12 previous year question paper practice

- Complete assistance for NIOS TMA Class 12 preparation

For academic support:

Phone/WhatsApp: 9654279279, 9899436384

Frequently Asked Questions (FAQs)

Q1. Is the NIOS Class 12 Accountancy 320 Question Paper difficult for average students?

The Accountancy 320 paper is not difficult if the concepts and formats are clear. Questions are syllabus-based and predictable. Average students who practise numericals regularly and revise theory properly can score well without unnecessary pressure.

Q2. Which section is the most scoring in Accountancy 320?

Practical numerical questions are the most scoring section. Students who follow correct formats, show proper workings, and avoid calculation errors can secure a large portion of marks from this section alone.

Q3. How important are previous year question papers for Accountancy preparation?

Previous year question papers are extremely important because NIOS repeats patterns and accounting formats. Practising them improves speed, accuracy, and understanding of examiner expectations, which directly increases final scores.

Q4. How should journal entries be written to score full marks?

Journal entries should be written in the correct sequence with proper debit and credit sides, correct amounts, and clear narrations. Even small mistakes in accounts or narration can reduce marks significantly.

Q5. Can Accountancy be prepared well in the last three months before the exam?

Yes, Accountancy can be prepared effectively in three months with disciplined practice. Daily numerical practice, revision of formats, and regular solving of full questions are enough to score confidently in the exam.

Final Conclusion

The NIOS Class 12 Accountancy 320 Question Paper (Set C) October 2025 clearly shows that success in Accountancy depends on conceptual clarity, correct formats, and disciplined numerical practice. Students preparing for 2026 should focus on final accounts, partnership, company accounts, and presentation quality rather than shortcuts.

Unnati Education provides solved papers, TMAs, and previous year question papers to support students throughout their Accountancy preparation. If you need solutions, TMA support, or academic guidance, you can contact Unnati Education for reliable help.